New 1099 Rules 2024 Forms – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . The 2024 tax-filing season opens on Jan. 29. Be on the lookout for a W-2 from your employer, as well as various 1099 forms. Some of those recharge and experience new things. .

New 1099 Rules 2024 Forms

Source : markjkohler.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduHow Did Your 1099 Season Go? New E Filing Rules Challenged Some in

Source : www.cpapracticeadvisor.comIRS Delays 2023 Form 1099 K Threshold, Introduces $5,000 for 2024

Source : www.drakesoftware.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.comSmall business 1099: Complete guide for 2024 | QuickBooks

Source : quickbooks.intuit.comIRS Form 1099 in 2024: W 9, Backup Withholding and the New De

Source : clatid.io1099 Rules Business Owners Should Know in 2024

Source : tipalti.comIRS Announces Another Delay in Form 1099 K Reporting | Optima Tax

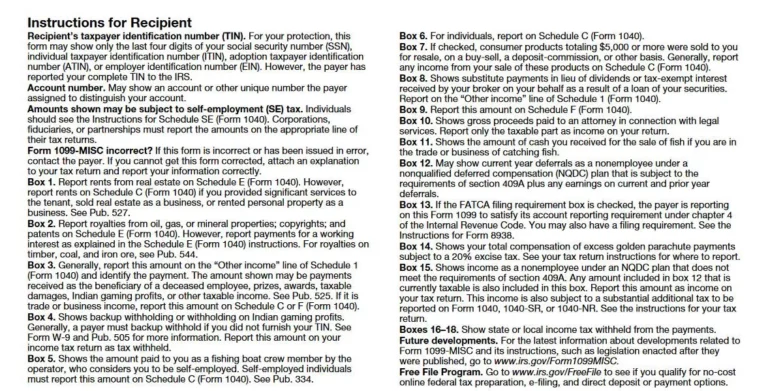

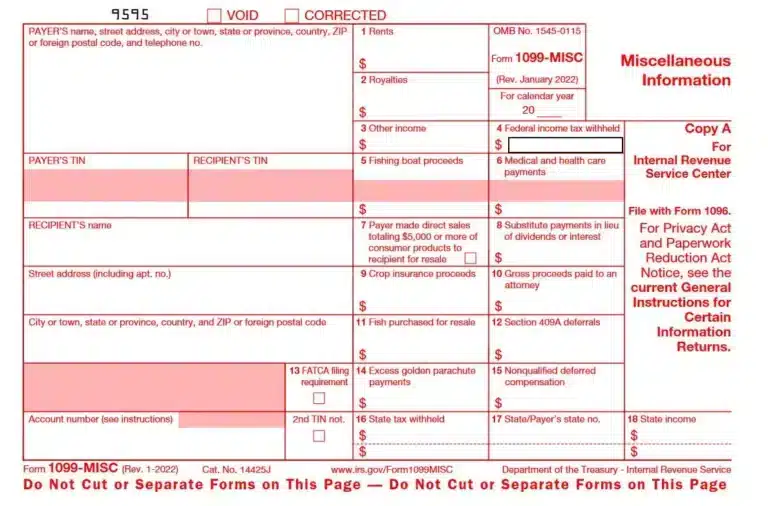

Source : optimataxrelief.comForm 1099 MISC Explained: Instructions and Uses

Source : tipalti.comNew 1099 Rules 2024 Forms 1099 Rules for Business Owners in 2024 Mark J. Kohler: If the interest is credited at maturity, you will receive a tax form for 2024 — not for 2023, said Ken Tumin, founder of DepositAccounts.com, a site to compare yields on CDs, savings accounts and . If you haven’t received all of your IRS Forms 1099 already, you should soon and in many cases the tax rules are not clear. For example, if you settled a suit and received taxable damages .

]]>